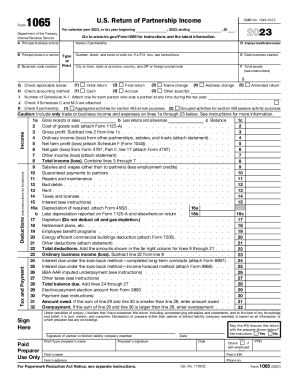

IRS 1065 2024-2025 free printable template

Show details

6a b Qualified dividends 6b c Dividend equivalents 6c Royalties Net short-term capital gain loss attach Schedule D Form 1065. Net long-term capital gain loss attach Schedule D Form 1065. Collectibles 28 gain loss. 9b Unrecaptured section 1250 gain attach statement. Complete Schedule K-3 Form 1065 Part XIII for each foreign partner subject to section 864 c 8 on a transfer or distribution. disclosure requirements of Regulations section 1. 15b Qualified rehabilitation expenditures rental real...

pdfFiller is not affiliated with IRS

Instructions and Help about the IRS Form 1065

How to edit the tax form 1065 online

How to fill out tax form 1065

Video instructions and help with filling out and completing IRS form 1065

Instructions and Help about the IRS Form 1065

Preparing and submitting tax reports is a mandatory duty for any business. This task demands time, strict adherence to official guidelines, and meticulous attention to detail. pdfFiller makes this process a breeze. It provides everything you need to complete your Return of Partnership Income accurately and quickly. Check the guidelines below on how to prepare the IRS form 1065 fillable PDF with our platform.

How to edit the tax form 1065 online

If you need to make quick document edits while working on the IRS form 1065 printable template, pdfFiller has you covered. It's the most straightforward way to fill, modify, sign, securely store, and electronically file your tax reports online.

Here’s how you can edit your IRS form fillable PDF:

01

Click Get Form at the top of the page to open your form 1065 2025 version in the editor.

02

Fill out the blanks and click Next to move through the fields, ensuring none are overlooked.

03

Navigate through the pages using the left-side panel

04

Use the Cross and Check options to mark the appropriate empty boxes.

05

Make other crucial edits using the Erase, Blackout, or Highlight tools.

06

Click Sign to create an eSignature and add Date to finalize your document.

07

Click Done, create an account with a 30-day free trial, and proceed to file saving and sharing options.

08

Use the Submit to IRS or Mail by USPS options to file your tax report without leaving the editor.

Once finished, you can download your completed document, export it to your cloud storage, or access it anytime in your pdfFiller account.

How to fill out tax form 1065

Federal form 1065 is a complex, six-page report on the partnership return of income. It provides details on the business's income, deductions, gains, losses, credits, and other important tax-related information. Following the detailed instructions on completing the document can help you avoid potential errors or discrepancies leading to penalties.

Step 1. Enter the beginning and end of your tax year. Provide the partnership’s name, address, and the date the partnership was started. Add to your tax form 1065 the business code number and the employer identification number (EIN).

Step 2. Complete the Income section (lines 1-7). Report the partnership's gross receipts or sales, cost of goods sold, and gross profit. Include ordinary income or losses from trade or business activities, and itemize other income according to the source and type.

Step 3. Declare deductions, specifying salaries and wages, guaranteed payments, rent, taxes, interest, and depreciation on the relevant lines.

Step 4. Calculate tax due or overpayment (lines 21-29). Compute the total income and deductions to determine the partnership's net income or loss. Use it to evaluate the potential tax liabilities or identify any overpayments for the year.

Step 5. Fill out Schedule B to provide additional details about the partnership's structure and activities, including its type, ownership changes, involvement in foreign or domestic partnerships, transactions with partners or shareholders, and any liability or tax-related matters.

Step 6. Complete Schedule K in form 1065 with net income (loss) information. Report the distribution of net income or loss among partners and include other specific financial details, such as self-employment earnings or tax-exempt income distributions.

Step 7. Fill out Schedule L (Balance Sheets per Books). Record the partnership's balance sheets, detailing assets, liabilities, and capital accounts at the beginning and end of the tax year to reflect the partnership's fiscal position.

Step 8. Reconcile income (loss) in Schedule M-1. Reconcile book income (loss) with analysis of net income (loss) per return reported for tax purposes. This ensures that discrepancies between book and tax financials are clarified and documented.

Step 9. Complete Schedule M-2 (Analysis of Partners' Capital Accounts). Detail the changes in partners' capital accounts over the tax year. Note contributions, withdrawals, and the allocation of net income or loss to provide a comprehensive view of each partner’s stake in the partnership.

Step 10. Finalize and file your tax form 1065. Ensure all the information is accurate before you sign and date the document. Check where to mail the 1065 form or submit it electronically with pdfFiller or on the IRS portal.

Video instructions and help with filling out and completing IRS form 1065

Show more

Show less

New Updates to Form 1065

What’s new in the form 1065

Schedule B updates

Schedule K-1 1065 form enhancements

Regulatory Updates

New Updates to Form 1065

Mastering the complexities of tax compliance is essential for precise tax reporting. For the 2025 tax year, the 1065 partnership return blank has undergone significant updates to boost transparency and comply with the latest legislative requirements.

What’s new in the form 1065

01

Electronic filing requirement: starting January 1, 2024, partnerships filing 10 or more returns of any type must submit federal form 1065 and associated schedules electronically. There are specific exceptions detailed in the official IRS instructions.

02

Qualified derivatives dealers (QDDs): Partnerships classified as QDDs or having a QDD branch must file the 1065 report under the new Qualified Intermediary Agreement.

03

Energy-efficient commercial building deduction: Line 20 has been revised from "Other deductions" to focus exclusively on energy-efficient commercial building deductions, reflecting legislative incentives for sustainable practices.

04

Elective payment election: Line 29 has shifted focus from "Amount owed" to the "Elective payment election amount" as reported on Form 3800, signaling changes in how elective payment amounts are reported.

Schedule B updates

“Schedule B: Other Information” of form 1065 2024 also contains some updates. Question 10 now includes sub-questions, expanding the required information. Additionally, Question 29 requests details about the excise tax on corporate stock repurchases, while a new Question 30 seeks information on digital assets. Finally, for clarity, the previous Question 30 has been renumbered to Question 31.

Schedule K-1 1065 form enhancements

There are also major modifications in the Schedule K “Partners’ Distributive Share Items”:

The item J box expanded to differentiate between sales and exchanges with clear instructions.

Item K has been expanded to include an additional checkbox, with each item now assigned a distinct number. Instructions have been clarified to specify information relevant to each item. Check the instructions for the new Item K1, Item K2, and Item K3 checkboxes.

Line 11: Individual codes now categorize various "Other income (loss)" items.

Line 13: Contributions are split into cash and noncash; other deductions received unique codes.

Line 15: Enhanced specification of "Other credits" with updated energy credits.

Line 20: Further delineation of "Other information" through individual codes.

Line 20c, code X: Now active to report payment obligations like guarantees and DROs.

Schedule M-1: The title was changed to Reconciliation of Income (Loss) per Books With Analysis of Net Income (Loss) per Return to clarify its purpose in income reconciliation.

Regulatory Updates

Domestic partnerships: The final regulations in T.D. 9960 classify domestic partnerships as aggregates of their partners for sections 951, 951A, and 956(a) for tax years starting on or after January 25, 2022. These regulations can also apply retroactively to tax years starting after December 31, 2017, if consistency requirements are fulfilled.

IRA partner disclosure: For IRA partners, the partnership should enter the employer identification number (EIN) of the IRA's custodian in Item E of the partner's Schedule K-1 (Form 1065). If the partnership reports unrelated business taxable income (UBTI) to an IRA partner on Line 20, Code V, it must also include the IRA's EIN on Line 20, Code AR. For additional details, please consult Items E and F and the IRA disclosure (Code AR).

Show more

Show less

All You Need to Know About The IRS Form 1065

What is the IRS form 1065?

Who needs to file form 1065 online?

When is the tax form 1065 due date?

Where should I file form 1065?

All You Need to Know About The IRS Form 1065

Understanding Form 1065 is crucial for any partnership looking to report its financial activities accurately to the IRS. Examine the document's purpose, its due dates, and how to file a 1065 report to meet the IRS requirements.

What is the IRS form 1065?

The federal form 1065, also known as the U.S. Return of Partnership Income, is a tax document used by partnerships to report income, deductions, gains, losses, and other financial information to the Internal Revenue Service (IRS). While partnerships themselves do not pay taxes on income, they "pass through" any profits or losses to their partners. Partners must include partnership items on their tax or information returns. Although there is no tax due on the partnership return, it provides crucial information that the IRS uses to ensure that partners have fulfilled their tax obligations on partnership items.

Who needs to file form 1065 online?

The tax form 1065 is required for any domestic partnership engaged in a trade or business, entities classified as a partnership for tax purposes, and certain limited liability companies (LLCs) treated as partnerships. It is filled out by the partnership itself, not the individual partners. Partnerships must file this report to comply with IRS regulations, regardless of whether they have taxable income or loss.

When is the tax form 1065 due date?

Typically, a domestic partnership must file Form 1065 by the 15th day of the third month after the end of its tax year, as stated in the IRS Form 1065 instructions. For partnerships using the calendar year, this deadline is March 15.

If the due date falls on a Saturday, Sunday, or legal holiday in either the District of Columbia or the state where the return is being filed, submitting the return on the next business day is considered timely. Calendar-year partnerships may, therefore, file their return for the 2024 partnership year by March 17, 2025, without penalty.

There's a form 1065 late filing penalty for a partnership if it either (a) fails to file by the due date, including extensions, or (b) submits a return lacking required information, unless there's a reasonable cause. The penalty amounts to $235 per month (up to 12 months) for each partner present at any point during the tax year. Upon receiving a penalty notice, the partnership can provide an explanation to the IRS, which will determine if it satisfies the reasonable cause criteria. Do not attach the explanation to the return.

Where should I file form 1065?

You can send your return of partnership income either electronically or by mail. The IRS recommends e-filing, as it is faster and reduces errors. When mailing your report, the address will vary depending on the location of the partnership and whether a payment is included. You can find the specific instructions and addresses where to mail the 1065 form on the IRS website. Following the correct procedure is essential to ensure timely and accurate submission.

Here, you can find the correct IRS form 1065 mailing address.

If your partnership’s principal business, office, or agency is located in Connecticut, Delaware, District of Columbia, Georgia, Illinois, Indiana, Kentucky, Maine, Maryland, Massachusetts, Michigan, New Hampshire, New Jersey, New York, North Carolina, Ohio, Pennsylvania, Rhode Island, South Carolina, Tennessee, Vermont, Virginia, West Virginia, Wisconsin:

File your form 1065 to the Department of the Treasury, Internal Revenue Service Center, Kansas City, MO 64999-0011 if your total assets at the end of the tax year reported in item F is less than $10 million and Schedule M-3 isn't filed;

Send your return of partnership income to the Department of the Treasury, Internal Revenue Service Center, Ogden, UT 84201-0011 if your total assets at the end of the tax year reported in item F is $10 million and more and the Schedule M-3 is filed.

Irrespective of the amount of the total assets at the end of the tax year reported in item F and if your partnership’s principal business, office, or agency is located in Alabama, Alaska, Arizona, Arkansas, California, Colorado, Florida, Hawaii, Idaho, Iowa, Kansas, Louisiana, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Mexico, North Dakota, Oklahoma, Oregon, South Dakota, Texas, Utah, Washington, Wyoming, you should file your form 1065 to the Department of the Treasury, Internal Revenue Service Center, Ogden, UT 84201-0011.

If the partnership’s principal business, office, or agency is located in a foreign country or U.S. territory, irrespective of the amount of the total assets at the end of the tax year, the IRS form 1065 mailing address will be Internal Revenue Service, P.O. Box 409101, Ogden, UT 84409.

Show more

Show less

FAQ

What should a partnership report in the IRS form 1065 Schedule B under Section 267 A?

Section 267A prevents deductions for interest or royalty payments made through hybrid arrangements if there's no corresponding income inclusion under foreign tax law. Partnerships must report the total disallowed deductions on line 22, Schedule B, for any partners affected.

To which partners does Section 267A apply?

Section 267A applies to partners who are U.S. tax residents, controlled foreign corporations with significant U.S. shareholders, or foreign tax residents with a U.S. taxable branch. It doesn't apply if a de minimis exception is met. Check Regulations sections 1.267A-1(b), 1.267A-5(a)(17), and 1.267A-1(c) for details.

To which payments does Section 267A apply?

Section 267A targets interest or royalties paid through hybrid arrangements involving related parties or structured setups. It also applies to non-hybrid arrangements where related parties use hybrid deductions to offset income. Interest and royalties are broadly defined under this section. To correctly complete Schedule B in your tax form 1065, check the Regulations sections 1.267A-2, 1.267A-4, and the anti-avoidance rule in 1.267A-5(b)(6).

Where can I get IRS form 1065 fillable PDF?

You can find the required fillable template on the IRS website. Download the document and fill it out electronically using the IRS native eFiling portal or other online document management tools. pdfFiller also provides the latest version of the IRS form 1065 fillable PDF with the ability to instantly upload it to the editor, where you can quickly fill out, eSign, and submit your report.

How can I modify 1065 forms without leaving Google Drive?

To modify any tax documentation directly from Google Drive, connect your Google account with pdfFiller. First, sign up for pdfFiller and install its add-on for Google Drive from Google Workspace Marketplace. This setup allows you to manage your tax reports and other documents efficiently within your Google Drive.

How do I edit IRS form 1065 online?

The best way to do it is using pdfFiller. It’s a robust yet intuitive online document management platform trusted by millions of users worldwide. It provides various editing capabilities, legally binding electronic signatures, and secure file-sharing options to make your tax report submission efficient and fast.

What is the difference between forms 1065 and 1120S?

Form 1120-S is used to report the income, gains, losses, deductions, and credits of a domestic corporation or entity that has elected to be an S corporation for the tax year. In contrast, IRS form 1065 is designed for partnerships to report their income, gains, losses, deductions, and credits.

What is code A on K-1 1065 form?

Box 20, Code A indicates the taxpayer's portion of investment income, such as interest and dividends, derived from the partnership. This income should already be reflected in the Income section of this K-1. The figure in Box 20, Code A, is provided solely for informational purposes.

What is the difference between a K-1 and form 1065?

Schedule K-1 is part of IRS form 1065, documenting each partner's share of a partnership's income, deductions, and credits for their individual tax returns. The 1065 return of partnership income gives the IRS a financial overview of the partnership, requiring partners to report and pay taxes on their earnings, whether distributed or not.

Do I need to file a 1065 if my partnership did not have income?

Domestic partnerships must file their return of partnership income unless they have neither income nor deductible expenses for federal tax purposes. This document serves as an information return necessary for partnerships, except in cases where there is no gross income or deductible costs.

Fill out form 1065