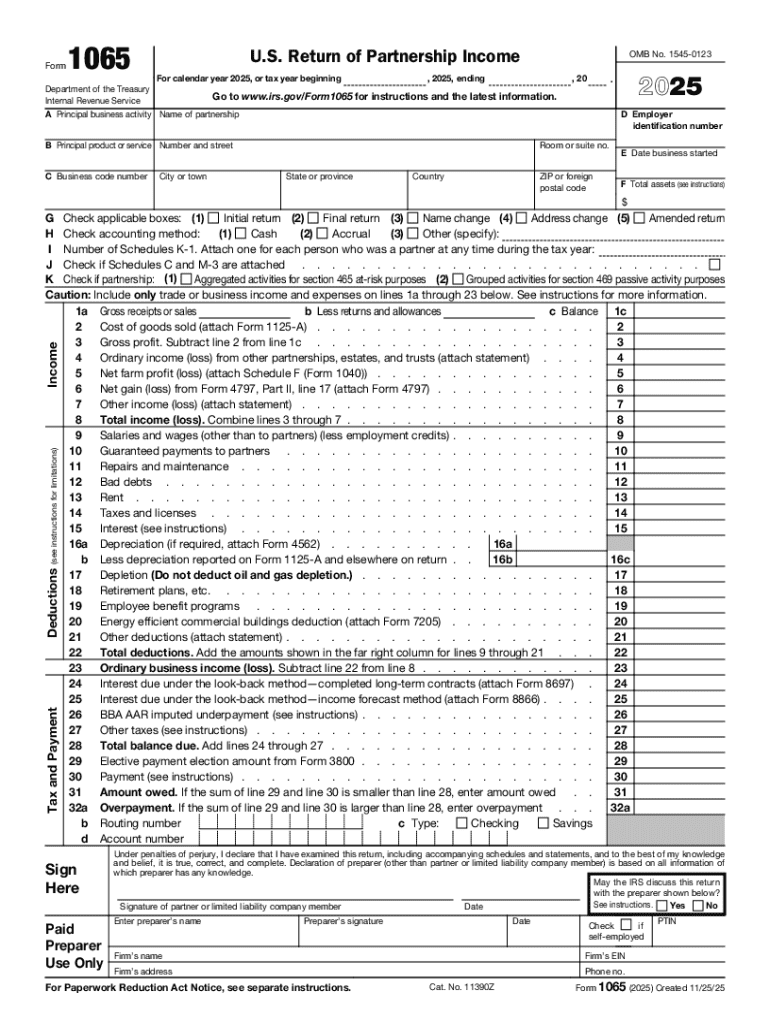

IRS 1065 2025-2026 free printable template

Instructions and Help about IRS 1065

How to edit IRS 1065

How to fill out IRS 1065

Latest updates to IRS 1065

All You Need to Know About IRS 1065

What is IRS 1065?

Who needs the form?

Components of the form

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

What is the purpose of this form?

When am I exempt from filling out this form?

Due date

What information do you need when you file the form?

Where do I send the form?

FAQ about IRS 1065

What should I do if I realize I made a mistake on my filed IRS 1065?

If you discover an error after filing your IRS 1065, you can submit an amended return using Form 1065-X. It’s crucial to ensure that all corrections are made accurately and submitted promptly to avoid potential penalties. Keep in mind that any adjustments could affect your partners and may require them to amend their returns as well.

How can I verify if my IRS 1065 has been successfully processed?

To verify the status of your IRS 1065, you can contact the IRS directly or utilize their online tools if you filed electronically. If you receive a notification about processing issues or a rejection, promptly follow the instructions provided to resolve any discrepancies. Keeping a record of your submission is advisable for tracking purposes.

What privacy and data security measures should I be aware of when filing IRS 1065?

When filing your IRS 1065, it's essential to ensure that your sensitive financial data is protected. This includes using encrypted channels for electronic submissions and safeguarding your devices against unauthorized access. Familiarizing yourself with IRS guidelines on data security can help mitigate privacy risks.

What should I do if I receive a notice from the IRS regarding my 1065 form?

Receiving an IRS notice regarding your IRS 1065 requires prompt attention. Carefully read the notice to understand the nature of the issue—whether it's a question of documentation, processing, or a discrepancy. Prepare any required documentation and respond within the specified timeframe to address the matter effectively.

Are there any common errors that filers make with IRS 1065, and how can I avoid them?

Common errors when filing IRS 1065 include incorrect partner information, misreporting income, and forgetting to include all required schedules. To avoid these mistakes, double-check all entries, confirm that information matches other tax documents, and, if possible, use tax software specifically designed for partnership returns.

See what our users say